@Ategy your unorthodox financial methods either deserve their own scientific dissertation or require that you do spend time studying how financial analysis and projections are made.

Usually when I do these sorts of things I start with a relatively simply Excel sheet with over simplified calculations. From there I make them more an more accurate and relevant then a few hours/days later I find myself with a very complex (but accurate) monster of a spreadsheet.

What you see in the pictures I post is just a tiny summary revue of all the calculations. That being said, it's still tiny compared to the computer-crushing epic spreadsheet system I have to maintain my lists for NameCult. Sometimes after some time I look at my own multi-line formulas and have no clue what I did .. I just know I got it to work (usually with a lot of help from Google .. lol)

Am I getting this right.. Your model suggest 5 domains sold per day at average of $2.8K per domain?

I mean, your maths may add up but the issue isn't mapping out maths.

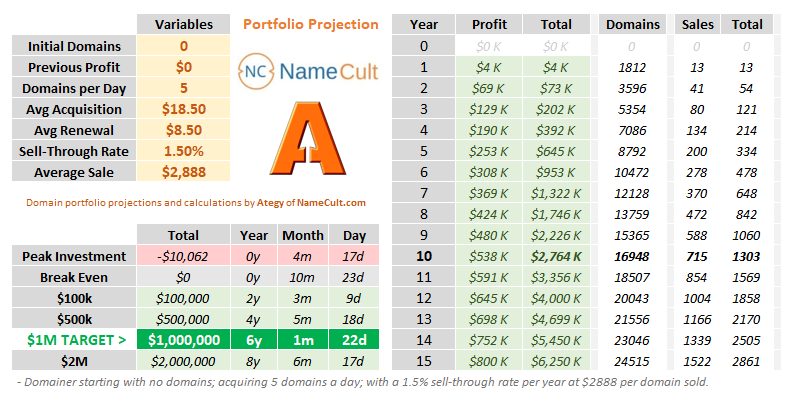

No. "Domains per Day" is acquisitions. Domain sales are shown for each year. In the case of the first example in this thread there are 13 domain sales in the first year. 41 in Y2, 80 in Y3, etc.

So this theoretical person is able to make enough sales by 4th month of starting to somehow finance buying 1200 more names while also paying renewals?

Kinda. You understand the concept, but for that first example the first sale actually is not enough to cover the ever shortening spread until the next sale. But it does happen after the 2nd sale. On the day before the 2nd sale the "running balance" bottomed out at $10,060. The day before the 3rd sale the balance is $10,040. Then as every sale comes faster due to an increasing portfolio, the balance slowly swings into positive territory.

In this specific model, by the time renewals start to kick in, the overall sales are strong enough to pay for 5 new domains a day as well as the renewals.

NOTE: That's for this particular theoretical projection. Everyone has different things that happen and different inflection points. That being said, here's that original 10k>1M projection with my updated spreadsheet:

Also, are you seriously assuming $2888 average sale price on closeout names? AVERAGE? Is that before platform commissions or after, by the way and are they factored?

I already mentioned that the sales price is obviously before any commissions. It has to be since different domainers use different venues to sell domains .. including their own (commissionless) websites.

Again, the $10k to $1M theoretical projection is just one of an infinite number of

possible routes to domaining success (or failure).

You can't have everyone reading through all your posts in the forum. It should be already clear in your NameCult post and that is quite confusing.

I had actually set this up deliberately as two separate threads. One for the article to simply discuss the theory and math and concept of being aware of your own portfolio's potential projection.

And also a 2nd discussion where I specifically invited people to give me numbers to plug into spreadsheet so we could then indeed specifically discuss what are and aren't realistic projections. I felt they were two very different conversations, but

@NamePros felt it was a duplicate post/thread, so they merged what were two different discussions, and in turn made this merged thread a little harder to follow.

(@Mod Team Alfa @Mod Team Echo @Mod Team Bravo @Mod Team Foxtrot)

That said I'm not saying you need to read every post in the forum .. I'm saying you'll find the answers to most of your questions as well as my reasons for doing this (not what you've assumed) in some of my previous posts in this thread. So if I don't go into much further detail, it's simply because I've already addressed most of what you said.

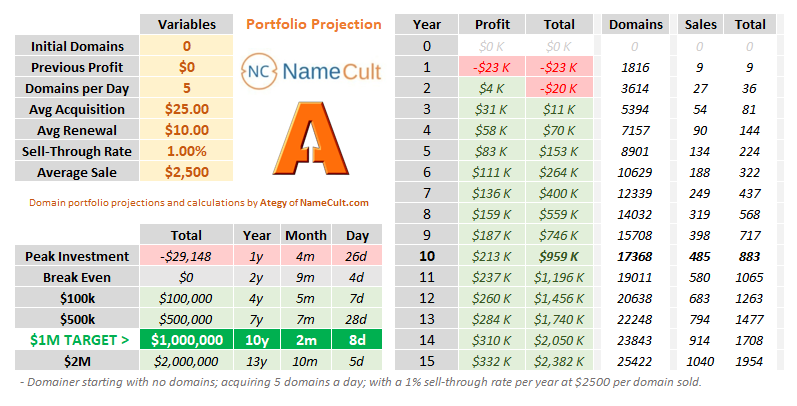

There is a reason around 50% of investors lose money, while your projection is pretty much is built on 100% return on investment. You could as well have assume 200% return and have shown 10000$ to 2.5 million in 5 years. Why not? Just assume something like acquisition cost of $6 from handregs and sale price of $3K with 1.5% sell through. There! Even more attention grabbing headline

lol .. what you're saying is actually kinda the reason I did this. And obviously I agree with most of what you're saying (things I've said myself several times in the past

). And by "this" I'm not talking about any single projection (as you seem to be focused on, but the actual point of this is more to be aware of and explore the math behind your own portfolios and domaining methods and tactics.

You could as well have assume 200% return and have shown 10000$ to 2.5 million in 5 years. Why not?

Yup .. again .. that's the point .. just to explore viable and ridiculous projections just for the sake of see what would happen .. so here it is .. the same variables but with 2.00% sell-through rate (which i think is what you meant because "Return" is more the end result, and not one of the starting variables):

Domain name sales swings quite a bit from year to year for me. I wish there was some kind of formula to turn $10k domain investment into $1M, so far I have not found one yet.

Again .. as I've warned in the article and said a few times .. this is just theoretical projections .. domaining is far too random with a lot of luck involved to truly ever have constant results. Once your portfolio grows to significantly larger sizes supposedly there is more consistency on the portfolio level. But to be clear "more consistency" does not mean "actual consistency".

Just assume something like acquisition cost of $6 from handregs and sale price of $3K with 1.5% sell through.

lol .. again .. because I can. But feel free to propose what you consider more realistic varibles .. because that's what the point of all this was!

Reality is much less sexy. Even if you have cracked the formula for what sells, you will achieve something like 50% on the capital employed, especially if you keep scaling up and don't have any other costs besides renewals and your time cost is zero.

Yes again! You aren't saying anything I don't agree with. This is a relatively simple spreadsheet (although I'm adding things as ideas come up in this discussion). I suppose I could factor in a time cost based on both (1) portfolio size (management and sales correspondence, etc) and (2) the time involved to find your 5 domains a day. But again .. everyone values their own time differently, so it would need to be yet another variable. Very doable .. but needless complex for the sake of this theoretical discussion.

To get to $1MM in 6 years, you'd need to be making over 100% on the capital employed, essentially more than doubling your money every year. (Simple math 2^6=64<100>2^7=128)

Again, my math is several generations more complex. I'm not doing calculations on a yearly level, but right down to the daily level. Also, my previous simply spreadsheet (similar to what most people do) didn't factor in reduced inventories due to sold domains. At the end of the day however .. yes .. someone with a good command of their portfolio or who is already successful in domaining, doesn't really need to know down to the finer details that my spreadsheet provides.

To Be Continued ...